Our work

We specialise in systems implementation in the Public Financial Management sphere

Our Portfolio

Eswatini Revenue Service (ERS)

Implementation of the Oracle Revenue Management and Billing (ORMB) system at the Eswatini Revenue Service, which involved:

• Gathering and documenting requirements

• Suggesting improvements in the fiscal law

• Designing the system and representing the functional needs to the system developers

• Process reengineering and implementation of international best practices

• Managing change

• Testing the system

• Training the staff, including developing the training materials

• Post-implementation support

Project management of the implementation of ORMB, including an online taxpayer portal (TaxEase)

Advisory services, including on the management of the transition to the Tax Administration 3.0 model

• Project team coordination and oversight, progress tracking and reporting, issue resolution

• Oversight of delivery of the training programme covering a range of taxation and technology topics

Lesotho Revenue Authority (LRA)

Implementation of the Lesotho Tax Modernisation Project

Implementation of the Lesotho Tax Modernisation Project

• Project management of the implementation of electronic tax portal (eTaxation) and Business Intelligence / Data Warehouse systems

• Project reporting to African Development Bank (donor)

• Coordination of systems analysis and design activities, including Business Process Re-engineering

• Oversight of delivery of extensive training programme covering a range of Taxation and technology topics

• Led the implementation of solutions targeting: VAT non-compliance detection & debt collection processes, financial and telecom sectors revenue mobilization and Small Business Tax (SBT) and informal sector initiatives

• Strategic/tactical assessment, planning and support in the areas of: tax legislation framework, change management & internal communications, taxpayer outreach & education, capacity-building and gender equity

Barbados Revenue Authority (BRA)

Integrated Tax Information System (RMS by Data Torque)

Integrated Tax Information System (RMS by Data Torque) Implementation Project—Business Process and Capacity-Building component

• Provided onsite process and procedural support for the design of the system

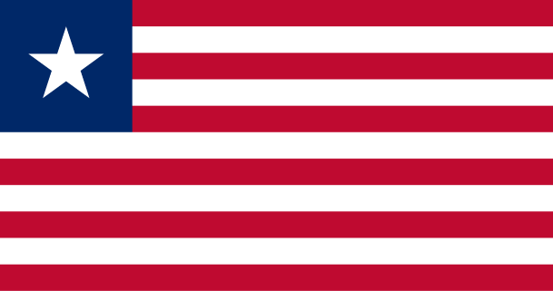

Liberia Revenue Authority (LRA)

Forensic review of the Customs and Domestic tax systems at the (LRA)

Forensic review of the Customs and Domestic tax systems at the (LRA)

• Conducted a forensic audit of the tax system (SIGTAS), including: a review of the business processes, system configuration, effective Standard Operating Procedures, management support, usage levels, data quality, documentation, user training, governance matters, and other related topics

• Processed an analysis to validate the taxpayers’ registration data quality and the overlap between the data from the inland tax and customs databases

The Gabon Tax Administration

Tax simplification project for the General Tax Directorate

Tax simplification project for the General Tax Directorate

• Reviewed the administration's current tax processes, as well as inventoried forms, manuals, guides and tools, identified bottlenecks, data redundancy and other issues

• Analysed the current integrated tax management system and the quality of the data

• Mapped the revamped fiscal processes and facilitated workshops for DGI stakeholders

Afghan Revenue Department

Afghan Revenue Department

• Designed and built an interim tax system which was in production for four years whilst a proper tax administration system was procured. This included the full the system development lifecycle including testing and implementation

• Contributed to legislative reform and modernization

• Process reengineering, knowledge transfer

• Directly managing 140 local ICT staff

The Bahamas

Bahamian Ministry of Finance

Implementation of a new tax management system (Data Torque’s RMS) at the new VAT Unit of the Bahamian Ministry of Finance

• As inland tax was an entirely new concept in the Bahamas, trained newly recruited employees on VAT concepts and the specifics of the Bahamian tax law

• Trained new employees specifically on the new tax system’s (RMS) registration module

• Supported the process of registering VAT taxpayers in RMS

• Segmented taxpayers and ensured as wide a coverage as possible of the tax base while managing tight time constraints

• Provided registrants with information and service as required.

Papua New Guinea

Internal Revenue Commission

• ICT Business Analysis (requirements gathering, policy development, process redesign, etc.) for the

implementation of the Revenue Management system SIGTAS

• Quality Assurance of tax administration software, bug tracking, etc.

• Design and management of Audit Programme, including supervision of multiple teams of auditors in the field

during the programme, policy development, penalty imposition, etc.

• Business Process Reengineering of administration processes for all job functions

• Redevelopment of all forms related to system processes, including development and programming of

intelligent forms for completion by the general public, such as the annual Corporate Tax Return

• Statistical analysis and reporting for the executive

• Introduction of electronic payments, credit card payments, and EFTPOS payments to PNG

• Data cleansing in preparation for go-live, and data analysis for strategic management

• Migration of Data and Accounts – including development of tools and procedures for migration

• Configuration of the system to enable it to support local legislation and requirements

• Technical Writing of public notices, guides, procedures, correspondence, reports, presentations, etc.

• Project Management, including Acting Project Manager, as required

Algeria

Algerian Ministry of Finance

Implementation of an integrated software solution for government budget preparation

• Audited all Algerian government institutions to build the macroeconomic and budgetary frameworks and to develop and implement the knowledge transfer plan

• Reengineered processes to increase transparency in government budgeting and improve overall performance of the government’s rendering of services

• Audited government institutions’ hierarchical structures, their parliamentary-mandated activities, their budgeting processes and their IT capabilities

• Built an Activity-Based Budgeting (ABB) framework in line with established international best practices

• Ensured that all persons responsible for budgeting activities were made aware of their new responsibilities and able to interact with the budget preparation software system through knowledge-transfer and equipment/infrastructure upgrades

• Broke down each ministry’s activities and brought them in line with quantifiable objectives to allow ongoing performance analysis and management and improve allocation of resources in line with the government’s overall goals

• Developed training materials and gave seminars to over 400 Algerian civil-servants on Results-Based Management and their duties within the new budgeting framework

• Aligned the government employees’ interests with the goals and ensured that all activity managers were trained on the use of the software for their budgeting

CILSS (Permanent Inter-State Committee for the Fight against Drought in the Sahel)

Configuration and implementation of a Monitoring & Evaluation platform for the CILSS

Configuration and implementation of a Monitoring & Evaluation platform for the CILSS

• Managed the configuration and the implementation of a proprietary system’s Monitoring & Evaluation platform

• Designed the M&E module and represented the business needs to the development team

• Managed the users’ training including the production of supporting materials and knowledge transfer

Timor-Leste

Timor-Leste National Directorate of Domestic Revenue (NDDR)

Implementation of a re-registration exercise for taxpayers using the existing tax management system (SIGTAS)

• Responsible for mapping processes and supporting change management using SIGTAS as the mission-critical tax management system

• Implemented the Paradox Box’s taxpayer deduplication module

• Led the training of employees as they were recruited or transferred from one position to another within the taxpayer re-registration exercise

• Coached employees involved in re-registration, supported the re-registration exercise when taxpayers presented themselves, and supported the 'back-office' re-registration processes such as analysing filing requirements, data entry and archiving, quality assurance, etc.

United Nations Transitional Administration in Timor-Leste (UNTAET)

• Developed the interim tax system

• Managed the procurement of the eventual Integrated Tax Administration System (ITAS)

• Building the ICT department of the new tax authority from the ground up

Nigeria

Nigerian Federal Ministry for Agricultural and Rural Development (FMARD)

Monitoring & Evaluation seminars

• Acted as a monitoring and evaluation subject matter expert at a series of Monitoring & Evaluation seminars organised by AfricaLead for the benefit of the Nigerian Federal Ministry for Agricultural and Rural Development

Nigerian Federal Inland Revenue Service (FIRS)

• Reengineering of core revenue management processes across the revenue service

• Managing and training of the project team

United Kingdom

London Transport

• Implementation and enhancement of automated financial management systems

• Programming the automation of accounting functions

Reed Elsevier (Publishing)

• Implementation of Hyperion Enterprise with system configuration and customisation

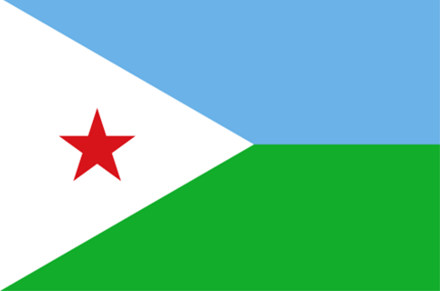

Djibouti Ministry of Finance

Support for the Public Service Reform Project

Implementation of a new tax system

• Prepared and guided the Djibouti tax office’s project staff on business analysis, process management, and coached them on what to expect in a tax system implementation project

• Provided the general director and the associate general director with support and advice in their negotiations with the system provider

Implementation of a new tax system

• Prepared and guided the Djibouti tax office’s project staff on business analysis, process management, and coached them on what to expect in a tax system implementation project

• Provided the general director and the associate general director with support and advice in their negotiations with the system provider

Australia

Treasury of the Government of Australia

• Project management for the enhancement of Australia’s eTaxation portal

• Requirements analysis for automated tax processing and accounting

• Quality Verification of system changes and enhancements to ensure correct functioning of the system and compliance with legislation

• Business analysis and systems design for accounting and case management systems for the treasury

Treasury of the Government of Australia

• Project management of Tax Administration software implementation (e-Tax replacement partnering with

IBM)

• Requirements analysis for Automated Audit using income matching, exception handling, thresholds to identify

audit cases. Technical Writing of public notices, guides, procedures, correspondence, reports, presentations, etc.

Australian Agency for International Development

• Financial Management Information System implementation

• Process reengineering to align the system with international best practices

Canada

Montréal Exchange

Contributed to the design, testing, training, and implementation of the Exchange’s new options trading system

Electronic Arts

• System design – CRAFT - Central Resource Allocation and Forecasting Tool (used for QA resource planning)

• Agile development / Scrum, including product backlog prioritisation and sprint planning

• User Stories and Business Rules elicitation and documentation

• Quality Verification of each release, detailed analysis of bugs, scheduling and testing fixes, etc.

• Product Backlog grooming and management – approx. 440 User Stories

• Development of 40+ detailed wireframes and screen mock-ups to convey system design

• Winner of new game concept competition Game Jam in 2017 (HUT Live DRAFT) and 2018 (Game Makers)

• Mobile Analytics - Detailed analysis of mobile game metrics (ARPU, LTV, Installations, the Golden Cohort,

etc.) for Star Wars, The Simpsons, SimCity, etc. using SQL queries and MS Excel.

Unreal Engine

• Video Game Development – Coding and design of video game “Pyramids”

Public Sector Pension Investment Board

Process audit:

• Audited the Public Sector Pension Investment Board’s

middle-office functions in order to prepare the selection and implementation of an integrated business solution

• Reviewed the risk management and compliance functions within the federal government employee’s pension fund to ensure that they are in line with the industry’s best practices

• Reviewed the department’s activities and developed a needs analysis which was then used to select and implement a dedicated business solution

Caisse de dépôt et de placement du Québec (Canada’s largest pension fund at the time)

Functional quality assurance lead for a trade management system implementation:

• Developed and implemented the project’s functional quality assurance plan

• Met with personnel from departments involved with the generation, compliance and settlement of trades to fully understand and document their processes

• Developed and delivered a knowledge transfer plan to ensure the adoption of the new system by all parties

• Implemented test scenarios, documented bugs, set debugging priorities and ensured post-debugging follow-up

CGI Inc.

Bill C198 implementation project

(Canada’s version of the American Sarbanes-Oxley compliance law)

• Developed training materials aimed at ensuring that sales and support staff who interacted directly with clients were compliant with the new legislation and followed the company’s procedures explicitly

• Focused on CGI’s documentation procedures and on sales opportunities the law created for clients who, themselves, needed the necessary IT infrastructure in order to ensure their own compliance.